Oahu Home and Condo Markets Cool in June

Sales and median prices dip, but pace of sales remains relatively quick

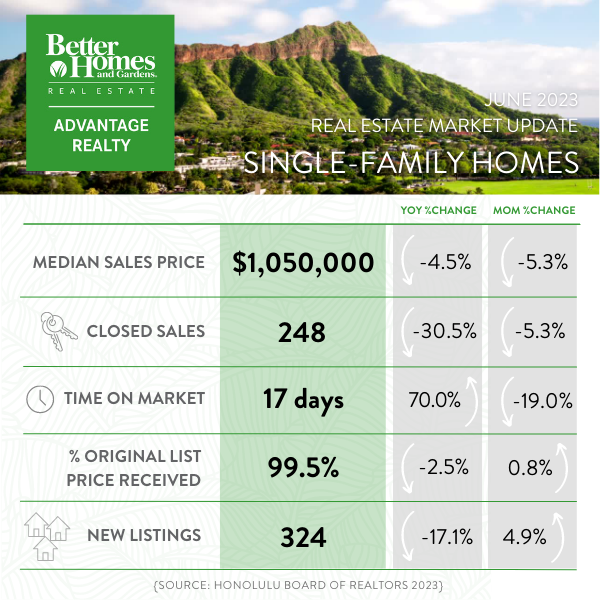

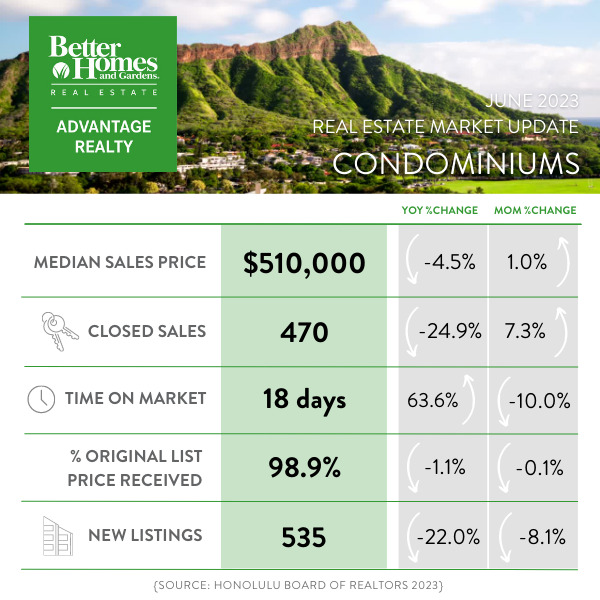

According to resales figures released today by the Honolulu Board of REALTORS®, the monthly median sales price for both single-family homes and condos fell 4.5% year-over-year. The single-family home monthly median sales price in June was $1,050,000, and $510,000 for condos. Single-family home sales dropped 30.5%, and condo sales dove 24.9% compared to the same time last year. However, the market pace remained relatively quick, with most properties entering a contract in just over two weeks.

“The directional shift in several market indicators—the modest pullback in median sales price, the slightly longer days on market and the dip in the percent of original list price received—affirm the transition from last year’s intense buyer competition to a moderating environment in some areas,” said the President of the Honolulu Board of REALTORS®. “Market headwinds that persist are low inventory and shifting affordability as average mortgage rates remain elevated from recent years.”

There was a noticeable impact on pending sales, with contract signings declining in both markets year-over-year and month-over-month as average mortgage rates rose in June. In the single-family home market, pending sales fell 24.3% year-over-year and 10.5% month-over-month. The condo market experienced a pending sales slump of 17.2% from June 2022 and 18.1% from a month ago. Throughout June, contract signings totaled 231 for single-family homes and 415 for condos.

“While market statistics provide a helpful overview, real estate is nuanced from neighborhood to neighborhood, so it helps to have an expert to guide you. It’s possible to achieve your real estate goals with support from experienced, trusted advisors,” added the HBR President.

Although both markets experienced double-digit sales growth from the first quarter of 2023 to the second—up 28.4% for single-family homes and 27.2% for condos—sales were approximately one-third down from a year ago for both the second quarter and year-to-date.

Through 2023, prices have somewhat steadied from the rapid rise seen through 2021 and the first half of 2022. Midyear, the single-family home year-to-date median sales price stood at $1,050,000, down 5.5% from the 2022 median price of $1,111,211. Similar to 2022, the $800,000 to $999,999 range accounted for a notable portion of single-family home sales in June 2023 and year-to-date at approximately 31% and 29%, respectively. The year-to-date condo median sales price was $500,000, just 2.9% below the June 2022 year-to-date median of $515,000.

The first half of the year saw 337 single-family homes, approximately 26% of sales, that closed for more than the original asking price, compared to 1,189 single-family homes or 61% of sales over the same period last year. Fourteen percent of single-family home sales received full asking price compared to 13% last year. In the condo market, 502 or 21% of sales closed above the original asking price compared to 1,589 condo sales or 43% in the first half of 2022. The share of condo sales that received full asking price was 21% year-to-date compared to 19% last year.

At the end of last month, active inventory was up in both markets compared to the same time last year. June 2023 ended with 605 active single-family homes, a 14.8% year-over-year increase, and 1,159 active condos, a 16.1% increase from a year ago. However, compared to pre-pandemic active inventory levels in 2019, single-family home inventory remained down more than 40%, while condo inventory was down more than 30%.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link