Attention Honolulu Homeowners!

Did you know? The home exemption program, first established in 1896 by the Republic of Hawaii, has been a key tool in providing tax relief and encouraging home ownership. Back then, the exemption amount was just $300!

Deadline Alert: September 30th!

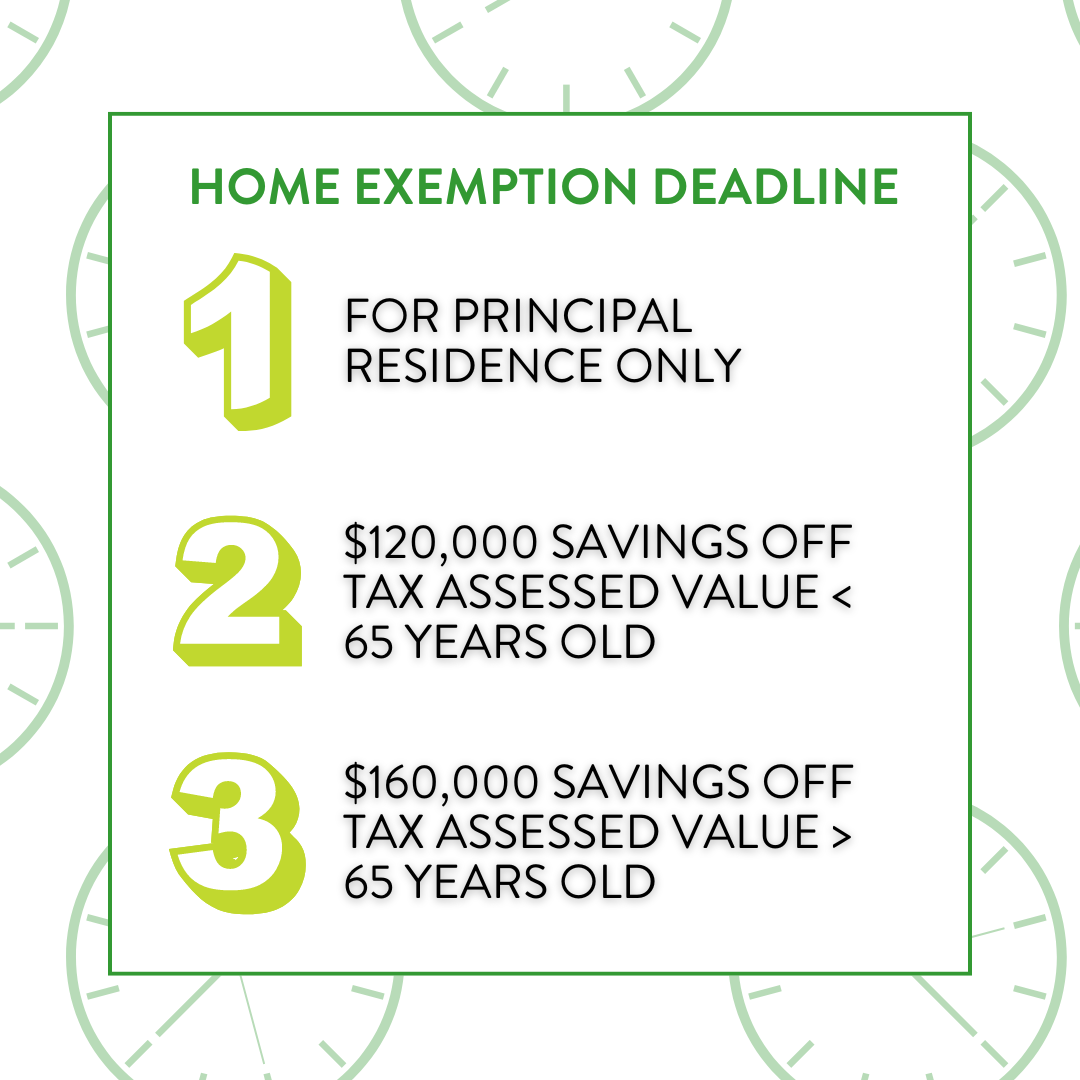

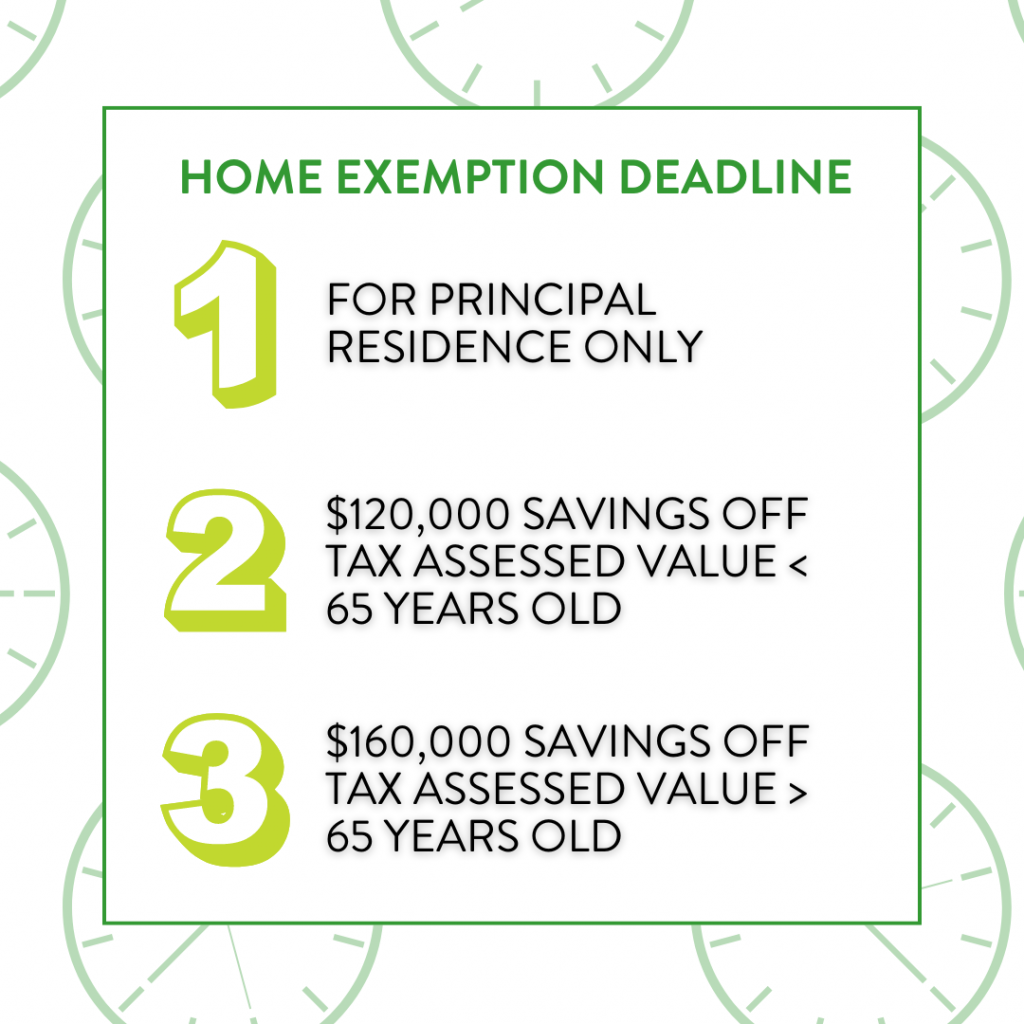

Starting tax year 2024-2025, the home exemption amounts are increasing:

- $120,000 for homeowners under 65 or those without a birthdate on file.

- $160,000 for homeowners 65 and older. (To qualify, you must be 65 or older by June 30 preceding the tax year.)

No need to re-apply if you already have a home exemption and your birthdate is on file. Your exemption amount will be updated automatically based on your age.

Don’t miss out on these valuable savings! Ensure your information is up-to-date and take advantage of this benefit by the September 30th deadline.

#Honolulu #HomeExemption #PropertyTax #TaxRelief #HomeOwnership #HonoluluHomes

to learn more, file online or download forms, visit: https://realproperty.honolulu.gov/tax-relief-and-forms/exemptions/home-exemption/

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link