Oahu Real Estate Market Report – April 2024 Home Sale Statistics

Home Sales Up Month-to-Month, Still Lag Compared to Pandemic Housing Frenzy

Single-family home buyers and sellers enter contract more quickly in April

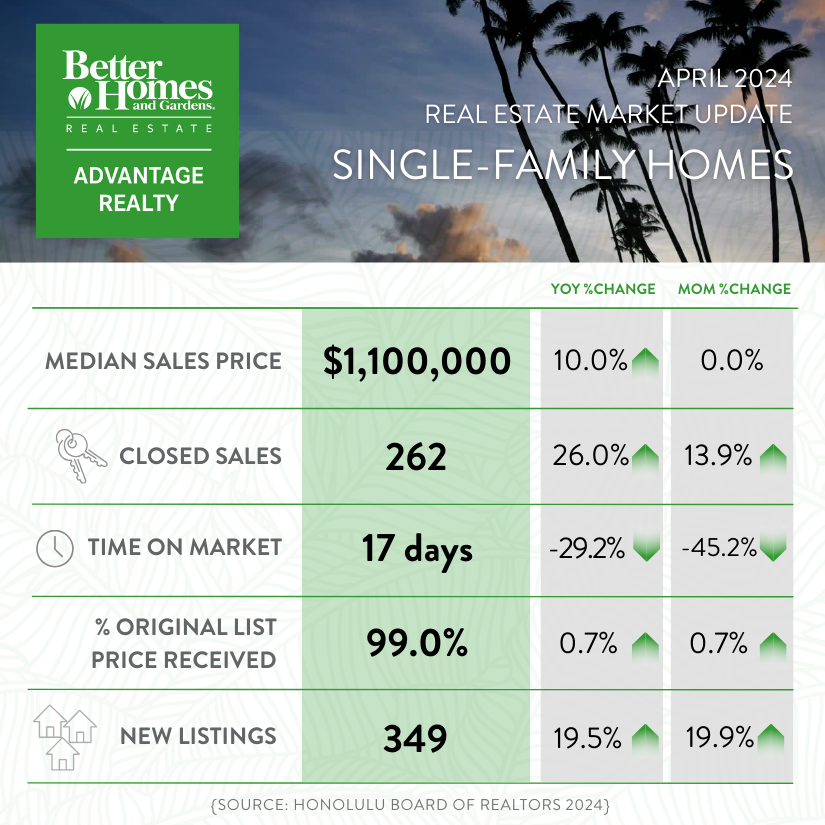

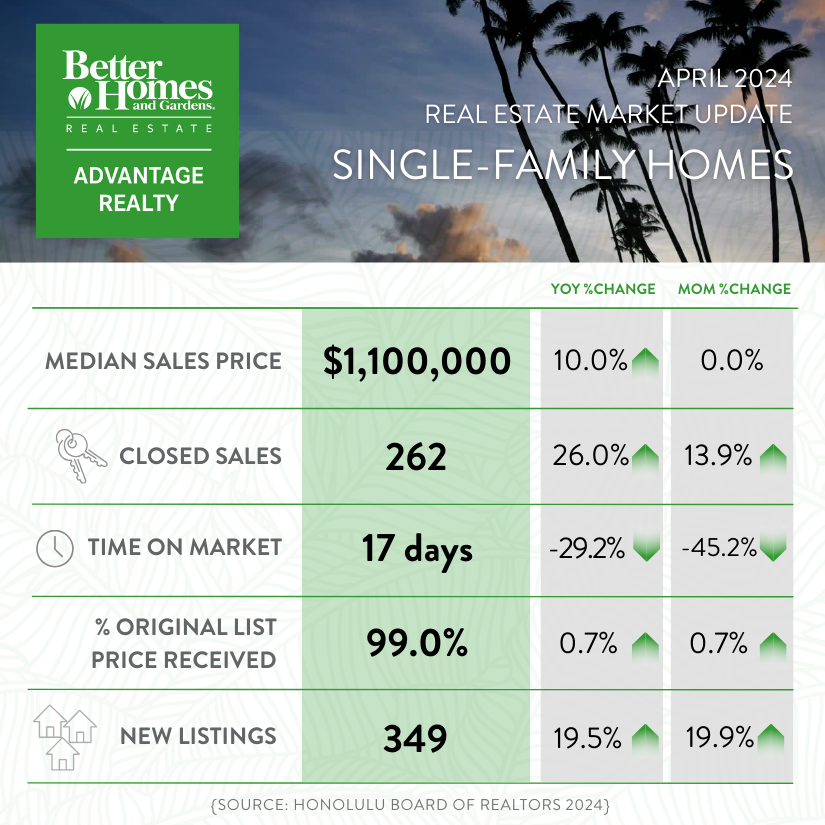

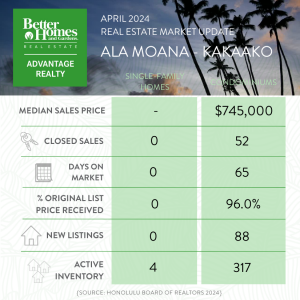

According to resale figures released today by the Honolulu Board of REALTORS®, April witnessed an uptick in single-family home and condo sales. Single-family home sales rose by 26.0% year-over-year, totaling 262 transactions, and by 13.9% monthover-month. Similarly, condo sales saw a 2.6% rise compared to the same time last year, totaling 431 units sold and a 25.3% increase month-over-month.

Despite the momentum change, sales remained at softened levels compared to recent years. Based on a 12-month moving average of sales, April’s average was approximately 40% below the peak moving averages observed in 2021 and 2022. Compared to the pre-pandemic moving average in April 2019, this month’s sales average indicates a decline of about 26% for singlefamily homes and 18% for condos.

Month-over-month, the median price of a single-family home remained steady at $1,100,000, though this marks a 10% year-over-year increase. Compared to April 2023, single-family homes within the $1,100,000 and above range surged 50%, with 132 sales compared to 88 in April 2023.

The condo median sales price grew 5.6% year-over-year and month-over-month, reaching $528,000 compared to $500,000 in April 2023. This upswing is driven by a change in sales activity, with a 35.1% decrease in condos sold within the $300,000 to $399,999 range and a 23.1% increase for condos priced at $600,000 and above.

“Though home sales haven’t reached pre-pandemic levels or the peak activity we noticed in 2021 and 2022, we’re seeing positive recovery signs for O‘ahu’s housing market,” said Fran Gendrano, president of the Honolulu Board of REALTORS®. “The month-over-month rise in sales indicates buyers are active in the market despite higher mortgage rates.”

Buyers and sellers moved quickly on single-family homes in April, with the median days on the market decreasing to 17 from 24 in April 2023. Additionally, one in three single-family home sales, or 33%, closed above the original asking price, compared to 25% in April 2023, suggesting increased competition. In contrast, condos took longer to sell, with the median days on the market rising to 29 from 20 last April.

Additionally, only 15% of condo sales closed above the original asking price this April, down from 22% in April 2023. Pending sales remained stable, with a slight year-over-year decline of 0.7% for single-family homes and a slight 1.1% increase for condos.

New listings observed positive growth, with 349 new single-family home listings and 656 new condo listings, up 19.5% and 23.3%, respectively. However, compared to 2019, new listing volume stayed below the 12-month moving average, dipping 36% for single-family homes and 20% for condos.

Active inventory gained a modest 6.4% for single-family homes and 5.6% for condos compared to the previous month. Year-over-year, single-family home inventory grew by 15.5%, while condo inventory surged by 37.8%. Single-family homes priced $1,000,000 and above rose 21.0% from last year, comprising 68% of the active single-family home inventory. Condo inventory also skyrocketed for units priced at $300,000 to $499,999, nearly doubling by 98.0% year-over-year, totaling 497 active units by April’s end.

“Nearly 90% of homebuyers and sellers choose to work with a REALTOR®. Consumers continue to see the value in working with a local real estate professional to guide them through what is typically the most significant financial transaction one makes in life,” Gendrano added.

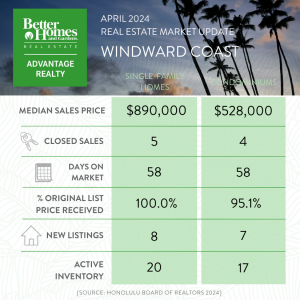

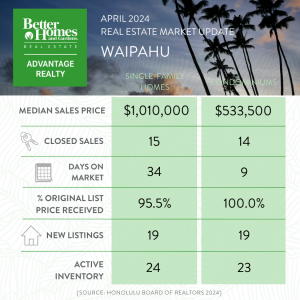

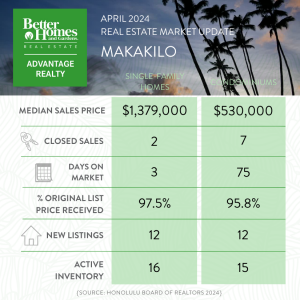

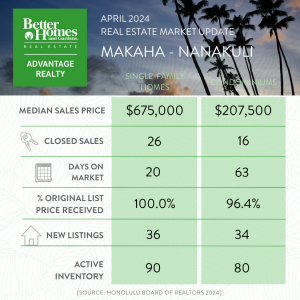

Single-family homes in the Leeward region experienced the most significant change in active listings, up 38.5%, and the Metro region experienced a 28.8% uptick. Hawai‘i Kai was the only region where active inventory declined for condos, dropping by 30.8% or eight units. However, the Metro region experienced the largest volume change in active inventory for condos, increasing by 27.9% or 244 units from a year ago, ending April with 1,119 active units.

For the full market report, visit:

source: Honolulu Board of Realtors

Oahu Real Estate Market Report – May 2023 Home Sale Statistics

Sales Volume of Oahu Homes Picks Up Month-to-Month, Still Down Compared to 2022

Properties in both markets spend longer on the market, approximately three weeks

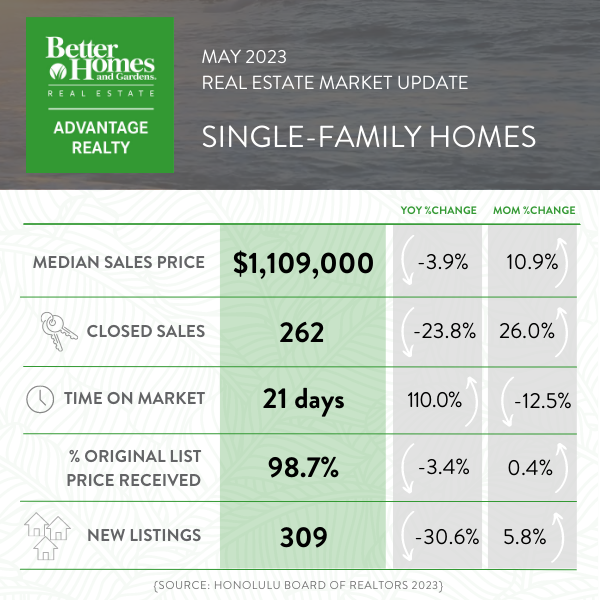

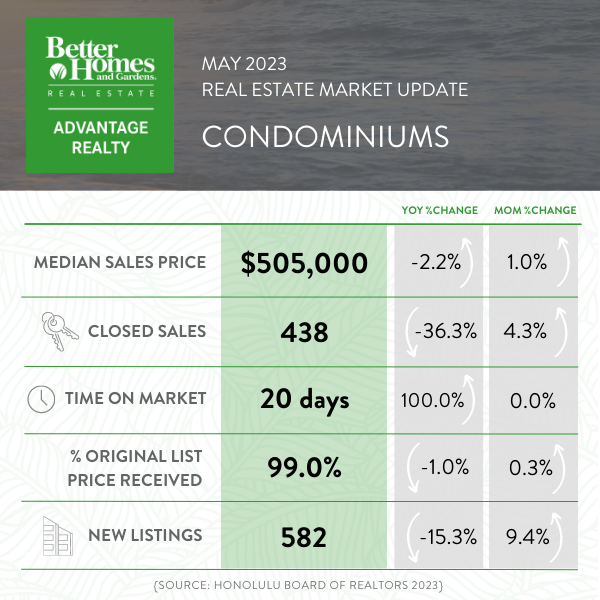

According to resales figures released by the Honolulu Board of REALTORS®, the sales volume of Oahu homes improved month-over-month, rising 26.0% for single-family homes and 4.3% for condos in May. However, closed sales declined 23.8% for single-family homes and 36.3% for condos compared to the same time last year.

The median sales price for a single-family home ($1,109,000) was 3.9% below the current record set in May 2022 ($1,153,500). Similarly, on the condo side, the median sales price dipped modestly by about 2.2% from $516,500 in May 2022 to $505,000 in May 2023.

“Despite lower sales volume, the median prices for Oahu properties haven’t changed much over the past year,” said the President of the Honolulu Board of REALTORS®. “Lack of inventory continues to drive demand as more kamaʻāina strive to become homeowners.”

Single-family homes and condos spent two times longer on the market than last year at 21 and 20 days, respectively, compared to 10 days in 2022. More single-family home sales closed at the full asking price or more than in the past seven months. However, this figure changes year-over-year, as approximately 45% of these sales in May received the full asking price or more, compared to about 75% of sales in May 2022. The same is true for condos, as roughly 45% of condo sales closed for the full asking price or more compared to 65% of sales in May 2022.

“Competition among buyers appears to be waning compared to 2022. However, more than a third of sellers continue to receive their full asking price or more in these market conditions,” added the HBR President.

Single-family homes in the $700,000 to $1,299,999 price range accounted for the majority of closed sales in May, at 67%. The ‘Ewa Plain recorded the largest share of single-family home sales at 25.6% (or 67 sales), representing the area’s most significant sales volume so far in 2023. Active inventory in the $700,000 to $899,999 price range experienced the largest increase in May. While active inventory increased in most neighborhoods, the Leeward region marked the most significant uptick, rising 55.6% to 70 active listings.

Meanwhile, condos in the $700,000 and up price range experienced a 48.5% drop in sales year-over-year. The Kailua region was the only area to see an increase in condo sales volume, with 18 sales this May compared to 13 sales in May 2022. Most price points for condos recorded an increase in active inventory, with a 39% uptick in the more affordable $400,000 to $699,999 price range.

{source: Honolulu Board of Realtors 2023}

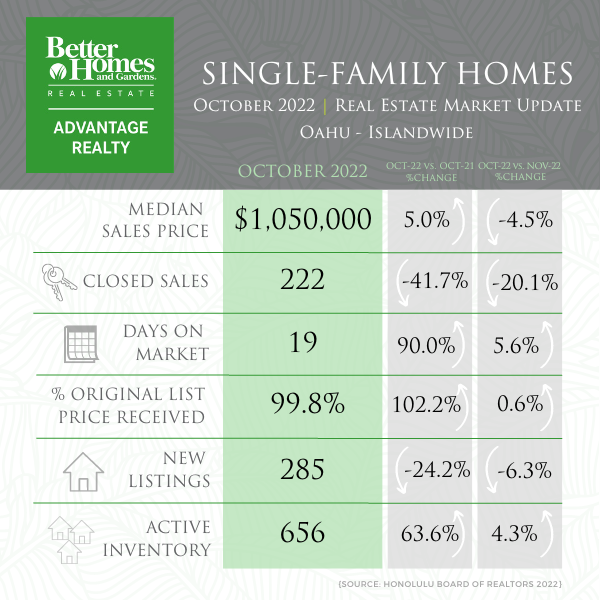

October 2022 – Oahu and Neighborhood Market Reports

|

||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

|

June 2022 Market Report and Neighborhood News

|

||||||||||||||||||||||||||||

|

May 2022 Market Report and Neighborhood News

|

||||||||||||||||||||||||||||

|

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link